The Math of Retiring Abroad

This post uses MoneyBee to explore the financial impact of various approaches to retiring abroad.

We often hear tentative plans of partial or full retirement abroad. Who wouldn't like to spend two months of the year in Greece or Italy, or spend their winters in the Caribbean? Some consider full-time retirement in their old country or in one of the charming havens for American retirees. Of course, few of these plans ever come to fruition. However, if you carefully plan it all out, chances are it might actually happen. So let's take a look at a few different strategies and do the math.

A couple months of the year in Europe (keep home in the States, rent abroad)

Let's start with the easiest strategy, which doesn't involve any major commitments. Jack is a homeowner in the States who plans to keep his home, but head out to Europe for a couple of months of the year. He thinks that he and his wife will have the energy and health to keep that routine for about 10 years after he retires at 65.

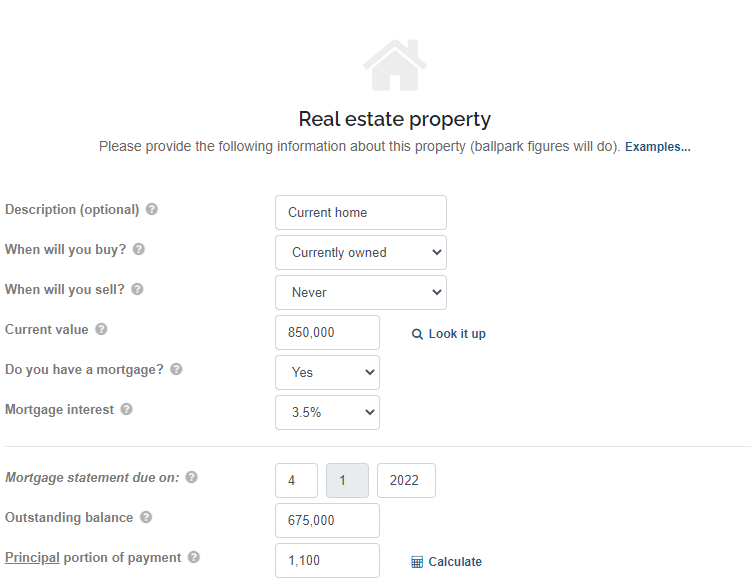

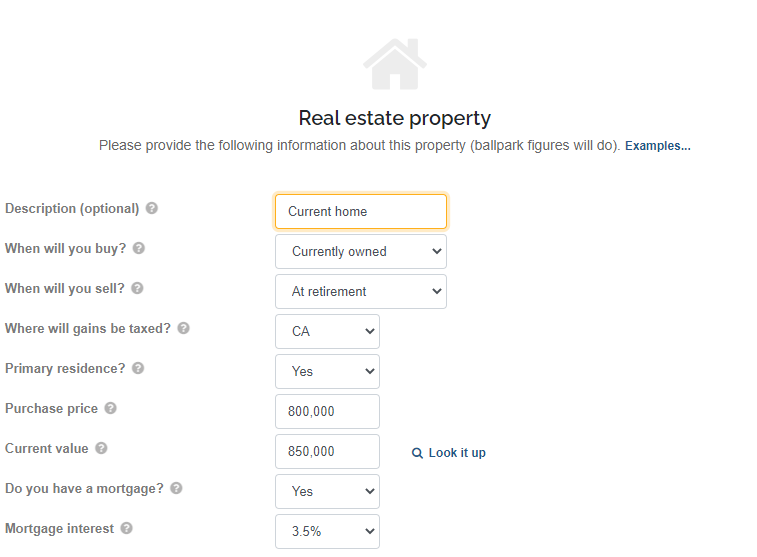

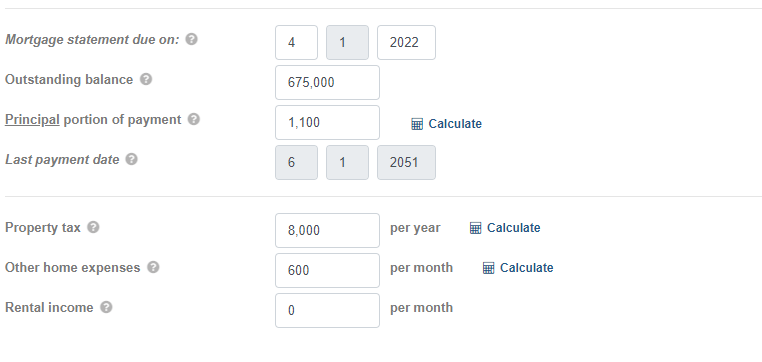

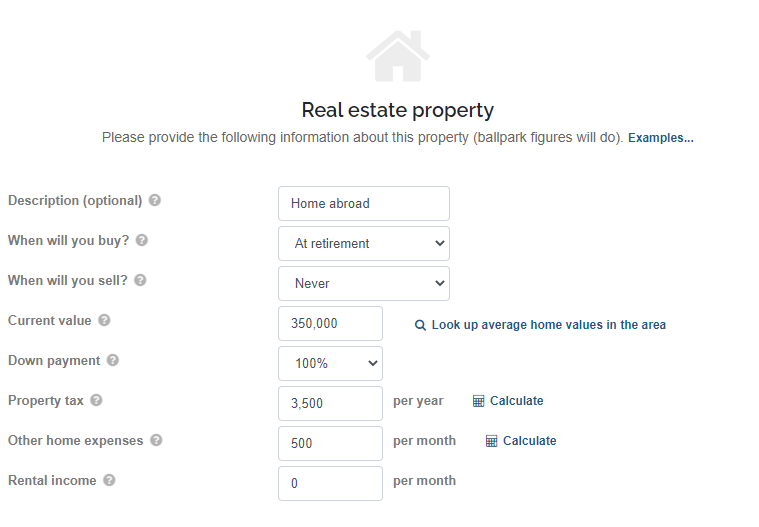

To model his current home in MoneyBee, he clicked "Add a property" in the Home section and filled it in as follows:

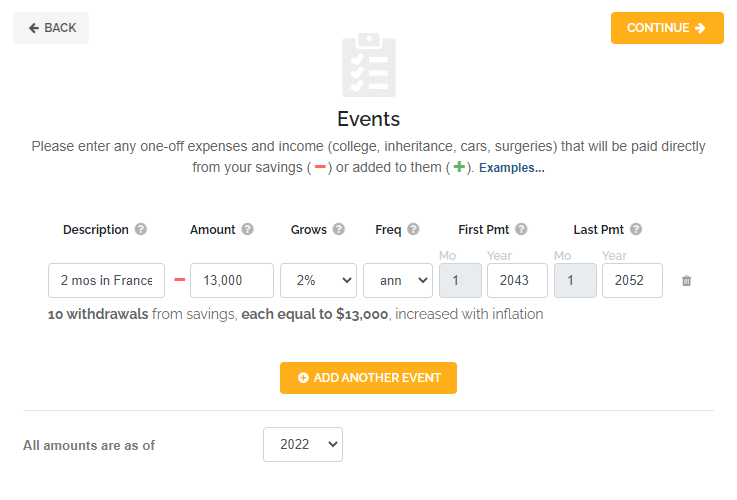

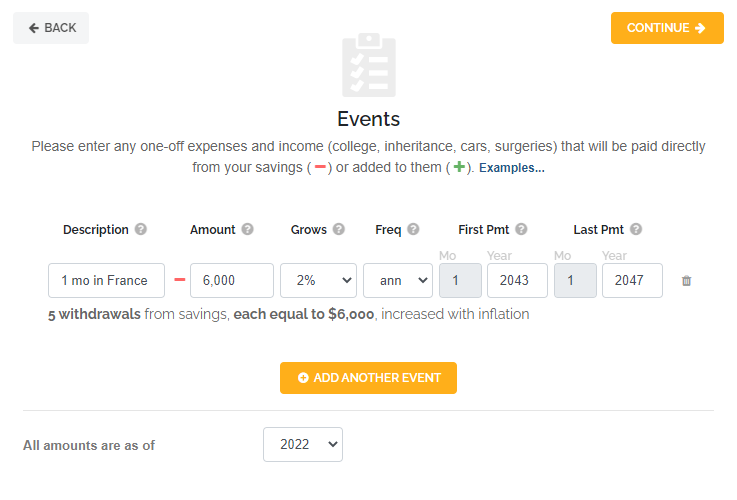

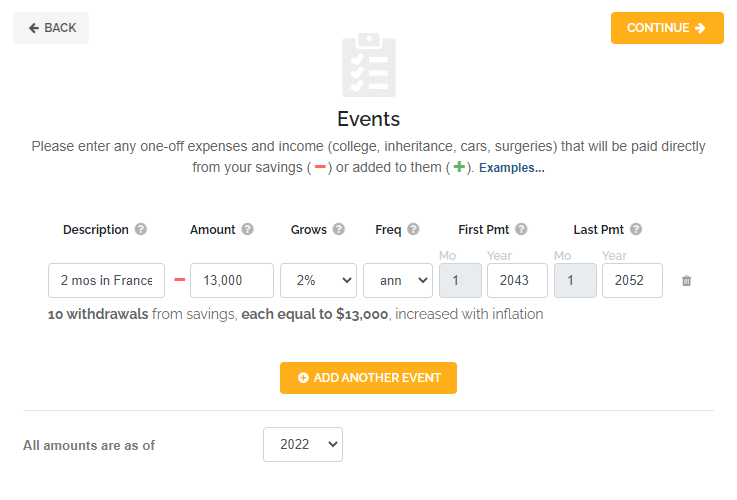

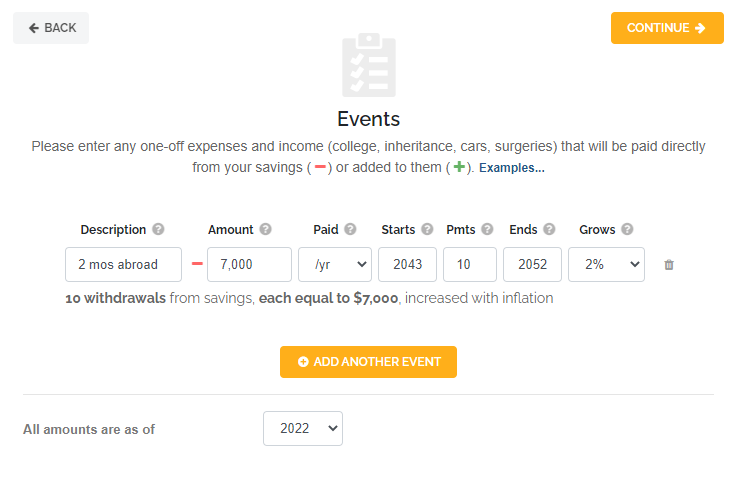

Next, he did some research to figure out his monthly rent abroad, in today's prices (all inputs in MoneyBee are in current prices and the app automatically increases them with inflation). He is thinking of using Nice, France as a base due to its central location and its very well connected and easily accessible airport and train station. Of course, the city's charm, dry sunny summers and crystal blue water factored into his choice too. Prices on Airbnb for an apartment in or near the city center varied between $1,500 and $5,000 a month, with plenty of very nice places around $3,000. He budgeted $6,000 for two month a year. Summer flights are expensive, so he budgeted $1,500 for him and his wife, or $3,000 total per year. He also budgeted another $4,000 per year for travel within Europe. That's $13,000 per year total.

He modeled this in the "Events" section of MoneyBee, which offers great flexibility in terms of timing:

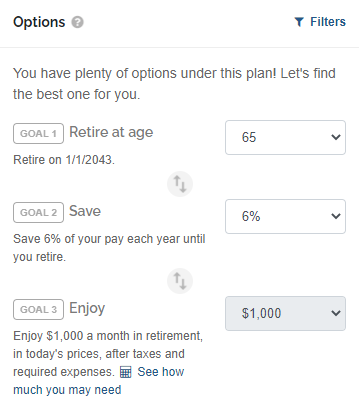

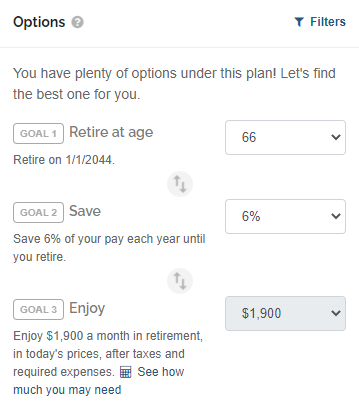

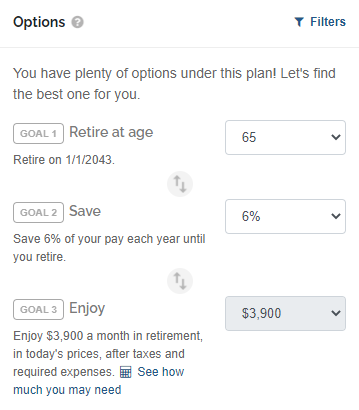

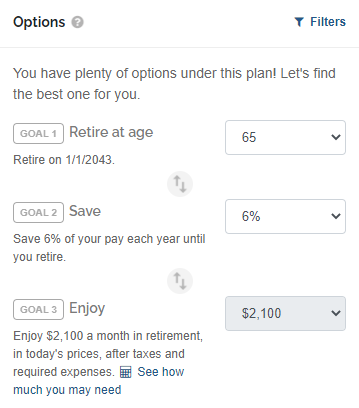

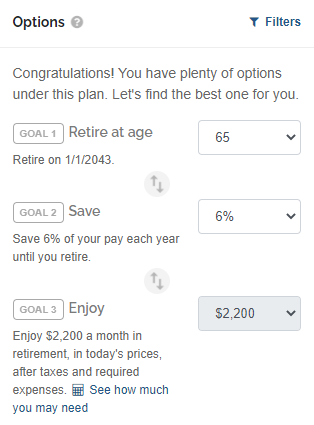

After finishing off the rest of the inputs in MoneyBee, Jack got the following options:

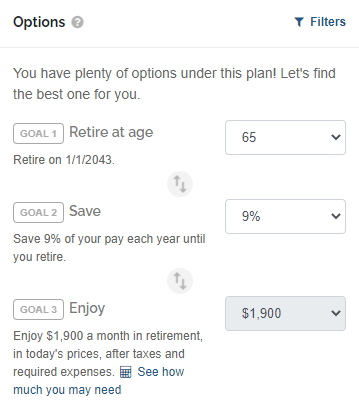

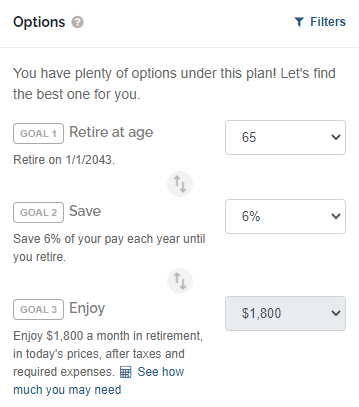

He certainly didn't think that a personal budget of $1,000 a month will work for them. He browsed the other options that MoneyBee produced and found a couple that will get him closer to the $2,000 budget he wanted:

They decided to try saving 9% of pay each year and retire when Jack is 65. If that turns out too difficult, they'll revert to saving 6% of pay and Jack will retire at 66. If neither works (they can't save more than 6% of pay and Jack has to retire at 65), they can also scale down their European travel. For example, they can go for one month at a time (instead of two), do it for 5 years (instead of 10) and live on their regular personal budget while in Europe (no extra allowance):

The difference it makes saving three extra percent of pay over a period of 20 years!

Downsize home in the States, rent abroad

As you could see from the previous example, living part-time abroad can be very expensive, especially if looking at some prime tourist locations. Even if shooting for more modest locations, as we start spending more and more time abroad, we start to feel that maintaining a large house with a sprawling yard back home makes less and less sense. The temptation to downsize our home at retirement is always there. It only intensifies when our large home turns into a part-time home. Let's do the math on downsizing our home in the States and see what difference that makes.

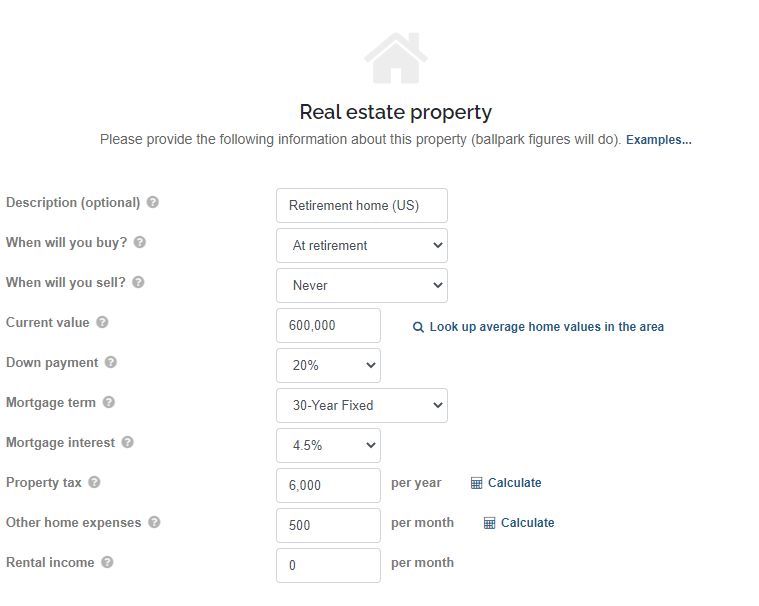

Suppose the couple in our example wants to sell their current home at retirement and buy a less expensive one with just 20% down. Here's how they can model these two real estate properties in MoneyBee:

They also changed their travel plans back to the more ambitious version:

When MoneyBee recalculated their options, their personal budget went from $1,000 to $3,900 due to the downsizing!

Even though the value of their new home is not that much lower than their current home, the fact that they chose to put only 20% down and finance the rest meant that most of the equity from their current home went to their bank account.

Downsize home in the States, buy home abroad

Downsizing your home after retirement can free up a lot of cash, especially if you take a mortgage on your new home. If you are really committed to an overseas region, you may be curious about buying a second home in that area. Let's take a look at what this might do to your retirement math. Building up on the above example, Jack added the purchase of a $350,000 home abroad in cash:

If he will have his own place there, he can reduce his travel budget by the $6,000 he planned to spend on rent abroad:

Even with this expensive purchase, his monthly personal budget was still around his $2,000 target. In fact, this is not a coincidence. Jack tweaked the purchase price of their home abroad until they got their desired personal budget.

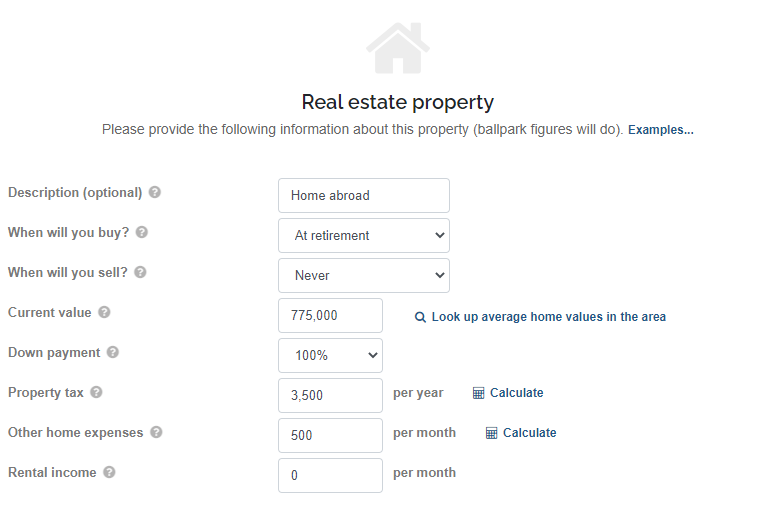

Sell home in the States, buy home abroad

While rare in practice, some people do sell their homes in the States and retire abroad full-time. There's a certain appeal to living in a place where everything is so much easier, simpler and less expensive than back home. To illustrate how the math may work, let's build on our last scenario (downsize in the States, buy home abroad) for the same couple. The only difference is that now they won't be buying a replacement home in the States. Because of that, they can now afford to buy a home abroad for $775,000 in cash and still reach their $2,000 a month personal budget target:

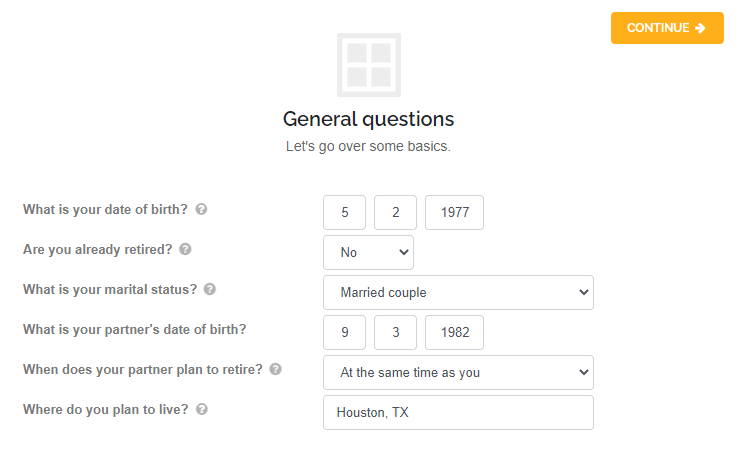

Please note that MoneyBee assumes you will pay U.S. federal taxes regardless of where you retire, which is true for all U.S. citizens. However, if you live abroad full-time, you won't have to pay state taxes. The easiest way to prevent MoneyBee from applying state taxes is to set your retirement location (which is required to be a U.S. city) to a state with no income tax, such as Texas or Florida:

Conclusion

Retiring abroad can be a challenging and expensive proposition. However, with careful planning, there might be quite a few exciting options within your reach. Spending a few months of the year abroad for several years is probably the most realistic option, especially if you are planning on downsizing your home in the States. Whatever the path you want to take, chances are that you will be able to model it in MoneyBee as part of your overall retirement planning. Living abroad can be one of the most enjoyable and personally enriching experiences of your life. All it takes is a little bit of math and some gut.